E&P Software Market Set to Surge to US$ 34.9 Bn by 2033 with Digital Transformation Driving Growth

Global E&P software market to grow from US$14.5 Bn in 2026 to US$34.9 Bn by 2033, driven by digital transformation in upstream oil & gas operations

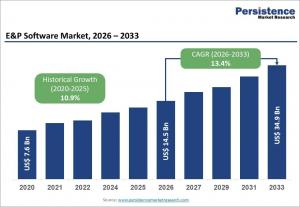

BRENTFORD, ENGLAND, UNITED KINGDOM, February 3, 2026 /EINPresswire.com/ -- The global E&P software market is witnessing a robust expansion, projected to grow from US$ 14.5 billion in 2026 to US$ 34.9 billion by 2033, at a CAGR of 13.4%. The surge in market growth is largely driven by the increasing adoption of digital technologies in upstream oil and gas operations, where complex geological formations and unconventional resources demand advanced analytics, real-time monitoring, and optimized production workflows. Operators are increasingly investing in software solutions to enhance efficiency, reduce operational risks, and improve asset life.

Among software modules, seismic processing & imaging leads with over 22% market share in 2026, valued at more than US$ 3.2 billion, due to its ability to provide accurate subsurface imaging and optimized exploration outcomes. Geographically, North America dominates, holding more than 36% share, driven by the U.S. shale resource base, offshore Gulf of Mexico projects, and early adoption of advanced E&P technologies. Meanwhile, Asia Pacific is the fastest-growing region, with a CAGR of 18.2%, propelled by unconventional resource development and software modernization initiatives in China, Indonesia, Vietnam, and Thailand.

𝐆𝐞𝐭 𝐚 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐃𝐅 𝐁𝐫𝐨𝐜𝐡𝐮𝐫𝐞 𝐨𝐟 𝐭𝐡𝐞 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.persistencemarketresearch.com/samples/33061

Key Highlights from the Report

Seismic processing & imaging is the leading software module with a 22% market share.

Risk management & compliance tools are growing fastest with a 17.1% CAGR.

On-premises deployment dominates the market with over 60% share in 2026.

Offshore operations are the fastest-growing segment with a 16.9% CAGR.

National oil companies (NOCs) are the largest end-users with over 35% share.

Asia Pacific is the fastest-growing region with an 18.2% CAGR.

Market Segmentation

The E&P software market is segmented based on software type, deployment mode, operation type, and end-user. By software type, seismic processing & imaging is the leading segment, supported by modules for reservoir management, drilling & production optimization, and risk & compliance tools. Among deployment models, on-premises solutions are preferred for data security, legacy system integration, and operational continuity, while cloud-based solutions are gaining traction due to scalability, remote collaboration, and IoT integration.

By operation type, onshore operations account for the largest share, given the extensive drilling, production, and exploration activities that rely on robust software support. Offshore projects are growing fastest due to deepwater exploration complexity, predictive maintenance, and stringent regulatory compliance requirements. In terms of end-users, NOCs dominate, while independent E&P companies are increasingly adopting cost-efficient, scalable software solutions to optimize unconventional resource production and digital transformation initiatives.

Regional Insights

North America continues to lead the E&P software market, driven by its mature upstream sector, advanced technologies, and significant shale oil & gas operations. The Gulf of Mexico offshore projects, coupled with high regulatory standards and the need for predictive analytics, further solidify the region's dominance.

In contrast, Asia Pacific is witnessing the fastest growth, fueled by emerging oil & gas operations in China, Indonesia, Vietnam, and Thailand. Rapid modernization of E&P operations, government incentives for digital adoption, and exploration of unconventional resources are driving software uptake across the region.

𝐃𝐨 𝐘𝐨𝐮 𝐇𝐚𝐯𝐞 𝐀𝐧𝐲 𝐐𝐮𝐞𝐫𝐲 𝐎𝐫 𝐒𝐩𝐞𝐜𝐢𝐟𝐢𝐜 𝐑𝐞𝐪𝐮𝐢𝐫𝐞𝐦𝐞𝐧𝐭? 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐂𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐨𝐟 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.persistencemarketresearch.com/request-customization/33061

Market Drivers

The primary growth drivers include increasing investments in shale oil, tight gas, and offshore projects, coupled with the need for digital transformation in exploration and production. Operators are seeking solutions that improve operational efficiency, extend asset life, reduce costs, and enhance predictive maintenance capabilities. Integration of IoT, AI, and cloud-based analytics is further accelerating adoption.

Market Restraints

Despite robust growth, the market faces challenges such as high software implementation costs, integration complexities with legacy systems, and cybersecurity concerns. Smaller independent operators may face financial constraints, while stringent regulatory frameworks can also slow deployment in certain regions.

Market Opportunities

The market presents significant opportunities in cloud-based deployment, risk management & compliance solutions, and AI-driven analytics. Expansion in offshore deepwater projects, unconventional resource development, and energy transition initiatives in Europe and Asia Pacific are expected to fuel demand for advanced E&P software solutions in the coming years.

Reasons to Buy the Report

✔ Gain comprehensive insights into global E&P software market size and growth trends.

✔ Understand segmentation by software type, deployment, operation, and end-user.

✔ Identify key growth drivers, restraints, and emerging opportunities.

✔ Benchmark regional performance and forecast trends up to 2033.

✔ Track competitive landscape and strategies of leading market players.

Frequently Asked Questions (FAQs)

How Big is the E&P Software Market?

Who are the Key Players in the Global E&P Software Market?

What is the Projected Growth Rate of the E&P Software Market?

What is the Market Forecast for E&P Software for 2032?

Which Region is Estimated to Dominate the E&P Software Industry through the Forecast Period?

𝐁𝐮𝐲 𝐍𝐨𝐰 𝐭𝐡𝐞 𝐃𝐞𝐭𝐚𝐢𝐥𝐞𝐝 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.persistencemarketresearch.com/checkout/33061

Company Insights

Key players in the E&P software market include:

Schlumberger Limited

Halliburton Company

Baker Hughes Company

Emerson Electric Co.

CGG S.A.

IHS Markit Ltd.

ABB Ltd.

Recent Developments:

Schlumberger launched a new cloud-based seismic imaging platform to enhance real-time data processing.

Halliburton introduced AI-driven reservoir modeling software to improve predictive drilling efficiency.

Related Reports:

Optical Communication and Networking Equipment Market

Pooja Gawai

Persistence Market Research

+1 646-878-6329

email us here

Visit us on social media:

LinkedIn

Instagram

Facebook

YouTube

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.